Digitalization in finance enables powerful protective technology to facilitate regulatory compliance and improve the customer experience

Banking is hardly the first industry to feel pressure from digital-first disruptors. These upstarts have capitalized on dissatisfaction with traditional banks, especially among younger customers. According to a Deloitte Insights survey, most customers prefer the simplicity and speed of digital banking transactions.

But digitalization in banking needn’t be exclusive to those disruptors. In fact, many major companies have incorporated digital solutions to great effect. All the while, they’ve maintained strict data security standards. Here are some of the processes that can benefit from finance digitalization.

To learn more about how digitalization is changing how we work, read the guide Digitalization in Business: An Executive's Guide.

Customer onboarding

Customer acquisition is a core part of any business. But that process has historically been a pain point for banking customers. The traditional model begins with the customer having to schedule a bank visit and travel there in person. Regular banking hours rarely extend past the end of the workday. As a result, a working customer can struggle to get to the bank during business hours.

Once they arrive at the bank, the customer must wait in line to speak to an employee who can help them open an account. The new customer must then fill out several paper forms by hand. Many of these forms collect the same information more than once. This helps in organizing, but it’s frustrating and time consuming. At the same time, the bank employee must manually check the information the customer provides and verify their identity. Not only does this take time, it can also be unreliable. Humans are more prone to error than algorithms when it comes to checking documents.

Throughout this process, the information the customer provides may be at risk. Anyone in the bank could steal it if they got a quick glance at the page. Even after it’s collected, the data may remain easy to read or copy. Security measures such as door locks and cameras may not always provide adequate protection.

Digitalization in finance accelerates customer acquisition

Digitalization in banking completely upends the onboarding process by putting it in the hands of customers. Rather than come into a bank, they can now open an account from anywhere with an internet connection. That’s especially true if the bank offers a mobile app. Opening a bank account has never been more convenient.

It can also be safer. Data can be encrypted when sent over a secure connection. That makes it incredibly difficult for bad actors to intercept or misuse it. As a result, customers can feel safe when filling out digital forms. These forms collect far less redundant information. That’s because the data can be automatically tied to the customer in question. There’s no need to file it manually. Instead, it goes straight to a secure cloud storage location for future reference.

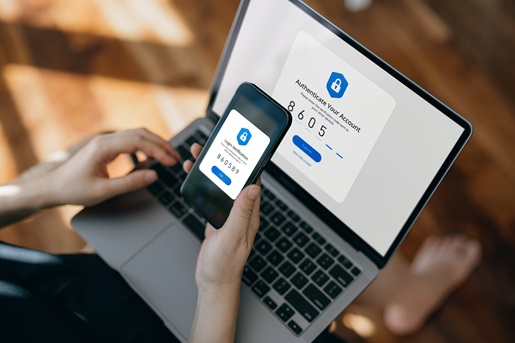

Additionally, customers can use their phones to scan their IDs, take selfies for ID verification, and complete a liveness check. Fingerprint and facial scans are the two most common forms of identification. These checks can happen in seconds using automation. Bank employees no longer need to perform that verification themselves, saving time. These checks also help keep a customer’s account secure after creation using two-factor authentication (2FA) during login.

Did You Know?:The RICOH fi-8950 production scanner can scan up to 150 double-sided pages per minute. With a 750-page document feeder and double-sided scanning, the fi-8950 is ideal for large-scale digitization projects. Click here to learn more.

Loan processing

Traditional loan processing can take a long time. Why? Because the relevant information is often spread across several repositories. An applicant’s credit history may live in one repository, for example, while their current financials are in another. Manually tracking down and collecting all the data for each application may require making phone calls, sorting through several storage locations, and faxing materials from place to place. This process is inefficient and reduces overall productivity.

Should any of that data need to move from branch to branch, costs can start to add up. That’s especially true when the data is sensitive customer information. The Federal Trade Commission recommends mailing sensitive info using overnight shipping that allows you to track delivery. Although this is safer than standard shipping, it’s not entirely without risk. As 1.7 million packages are lost or stolen every day, shipping sensitive information can become a compliance vulnerability.

Centralizing processing with digitalization

A core advantage of digitalization in banking is the power of centralized information. All the data a loan processor could need to process a loan can exist in one place. Using a computer, they can access all the data tied to a loan applicant’s account through cloud storage. That has myriad advantages. For one, organizing data takes less time because it all goes in one standardized location. For another, there are fewer opportunities for human error. Less manual recording and re-recording of data means fewer mistakes. And using a single storage location can reduce spending on technological overhead. These efficiencies add up to a faster loan process. That means more loans processed in the same amount of time.

Digitalization in finance also means sensitive data can be kept encrypted during transit and in storage. As a result, it can be shared with other locations safely and nearly instantly. Furthermore, banks can apply strict and granular controls to access. That prevents employees from seeing data they don’t need. It also helps contain damage from a breach, should one occur. This best practice security measure aids in achieving and maintaining compliance.

Customer experience

In theory, the traditional banking model provides the ultimate white glove treatment. Each customer receives individual attention from an expert banker. They quickly receive the help and answers they need. They leave happy with the service. As we discussed earlier, that is rarely how traditional banking actually proceeds. Customers frequently wait in line to receive help, even if their questions are simple. Employees at the bank may not have the answers right away. Plus, banks typically cannot operate 24/7. When a customer has a question outside of business hours, they’re often out of luck. In matters of fraud or identity theft, waiting until the bank opens can feel like an eternity.

Better support through digitalization

Banks can address many of these concerns by making their processes digital. Most simple transactions can take place entirely online or using a mobile app. More involved questions can be answered through chatbots. These widgets on company sites or mobile apps use artificial intelligence to get customers the help they need. If the questions are specific to the customer’s account, remote ID verification can help prevent fraud. 2FA logins, biometric ID, and automated alerts for unusual account activity can also help users protect accounts even outside of banking hours.

But digitalization in banking does more than improve existing processes. It also introduces entirely new benefits. For example, using data from the customer, your bank can provide personalized offer recommendations. Customers who want financial advice can use budgeting tools included in your app. They can even configure notifications around deposits, withdrawals, suspicious activity, and more.

Did You Know?:When documents scan properly the first time, your team can save time and effort. The RICOH fi-8950 offers automatic skew correction to keep pages straight, as well as proprietary Clear Image Capture (CIC) technology to preserve color and detail. Learn more here.

Our recommendation: fi-8950

Those curious about digitalization in banking and finance have a lot to learn about the potential benefits. However, moving to digital processes requires investing in the proper tools. We take great pride in having spent the last 50+ years researching, designing, and developing some of the most advanced and powerful electronics in the world, including our professional grade fi and SP series of scanners.

Built to purpose for the most demanding document handling jobs, fi and SP scanners are capable of processing tens of thousands of pages per day at the highest levels of accuracy. Their intuitive integration capabilities with all existing work suites minimize time-to-value for businesses looking to invest in tools that will pay dividends for years to come.

The RICOH fi-8950 offers the features that midsize and enterprise-level businesses need to digitize tens of thousands of documents every day. With a scanning speed of up to 150 double-sided pages per minute and an ADF capacity of 750, your business could easily scan tens of thousands of sheets each day. Proprietary Clear Image Capture (CIC) technology and up to 600 DPI image resolution ensure that records scan with high levels of clarity and detail. Sophisticated PaperStream software offers precise OCR, as well as simple options for naming and sorting files. Click here to learn more or shop the rest of our production scanner line.

Note: Information and external links are provided for your convenience and for educational purposes only, and shall not be construed, or relied upon, as legal or financial advice. PFU America, Inc. makes no representations about the contents, features, or specifications on such third-party sites, software, and/or offerings (collectively “Third-Party Offerings”) and shall not be responsible for any loss or damage that may arise from your use of such Third-Party Offerings. Please consult with a licensed professional regarding your specific situation as regulations may be subject to change.